Corporate Internet Banking

Overview

BankFlex® Corporate Internet Banking is a comprehensive banking service designed specifically for corporate customers.

The platform allows companies to set rules, limits, and approval process for their financial transactions. Businesses can now use BankFlex® corporate banking platform to handle payroll and trade finance to cash management and bulk transactions – all within an audited, secured and customizable digital environment.

The list of sophisticated banking operations includes Payroll, Trade Finance, Cash Management and many other features with delightful user experience, responsive screens, and fully audited and highly secure.

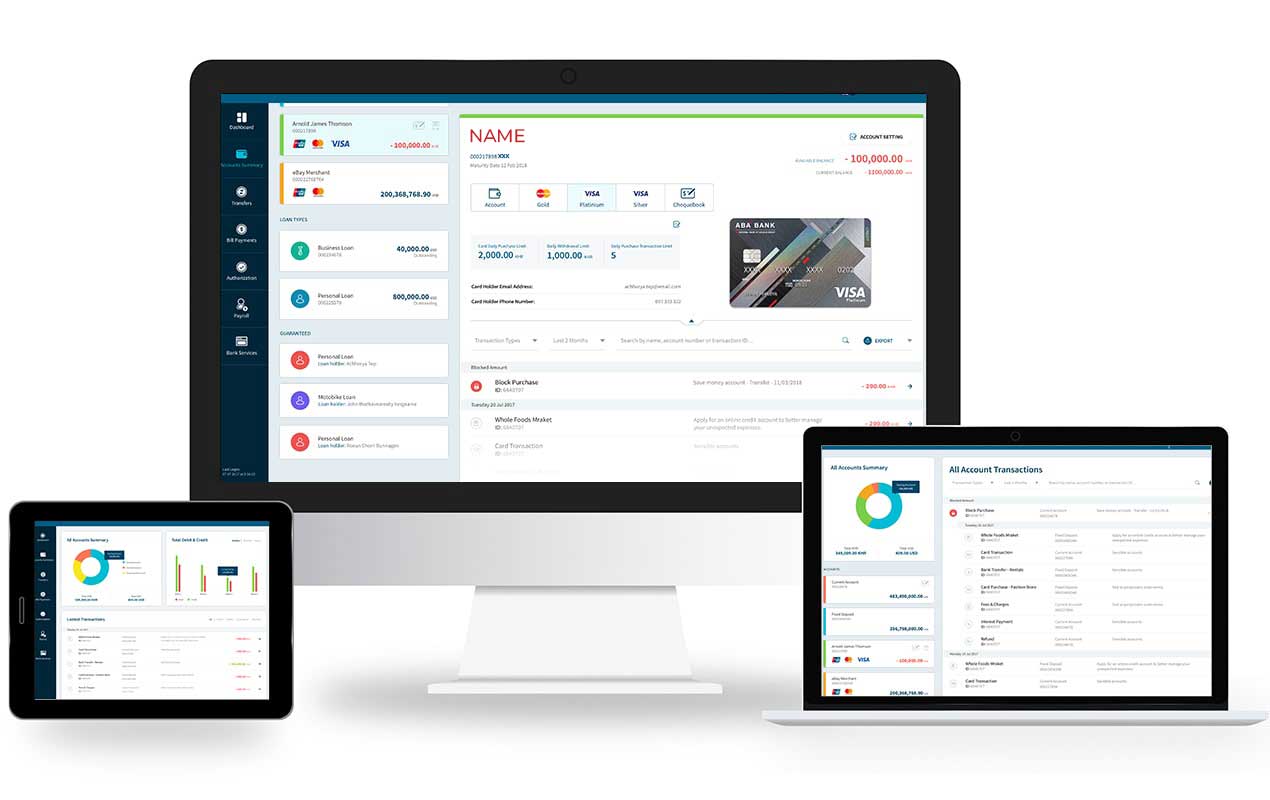

Your users can access BankFlex® Corporate Banking in all popular browsers and applications. Implemented using the latest user interface technologies such as Angular, HTML 5, CSS 3, BankFlex® delivers user-friendly and intuitive customer experience.

BankFlex® Corporate Internet Banking transforms the corporate banking landscape with its host of features:

Trade Finance Module: Covers all the required trade instruments including Letter of Credit, Bank Guarantee, Standby Letter of Credit, Trust Receipt and Revolving Short-term loan.

Cash Management Services: Enables features such as Sweeping, Netting, Payment Aggregation, Inward Discounting, and Notional Cash Pooling.

Multi-Level Corporate Authorization: Allows businesses to set up multiple levels of authorisarions for transactions.

Bulk Transactions: Businesses can import and export payments easily from customer accounting or ERP systems, using industry-standard formats for easy processing.

SmartSecure: Uses dynamic risk detection to identify and prevent security threats in real time.

Delightful User Experience: Designed with a clean, easy-to-use interface.

Robust Security: Supports configurable n-factor authentication, ensuring adaptable and highly secured applications.

Intelligence Driven Personalization: Uses intelligent insights to customize banking experience after analyzing user behavior.

Responsive Design: Features a customizable dashboard with configurable widget-based components and fully responsive user interface.

Comprehensive Auditing: Maintains data logs of all activities with non-repudiation features.