Integration With Accounting Software

Overview

In a major step towards providing corporate/business customers of the banks, Eon technologies has integrated its BankFlex® EASI Banking solution with Tally Prime. This breakthrough empowers corporate customers of the banks to perform secure banking operations directly from within their Tally accounting systems.

Now, corporate and business customers of the banks who deploy BankFlex® Digital Banking do not need to login into Internet banking or Mobile banking to perform banking operations. Thereby, banking becomes more streamlined, secure, and user-friendly for businesses.

BankFlex® EASI Banking app, installed on users’ office workstations, provides an intuitive and interactive interface that connects Tally ERP systems with the bank’s backend through BankFlex®. This integration facilitates all the critical operations in one place, making banking painless for institutions using Tally for their accounting processes.

BankFlex® EASI Banking app comes with a smart, and a highly secure role driven application which directly interfaces Tally with BankFlex for all banking operations. Additionally, the users do not need to login separately using internet or mobile banking.

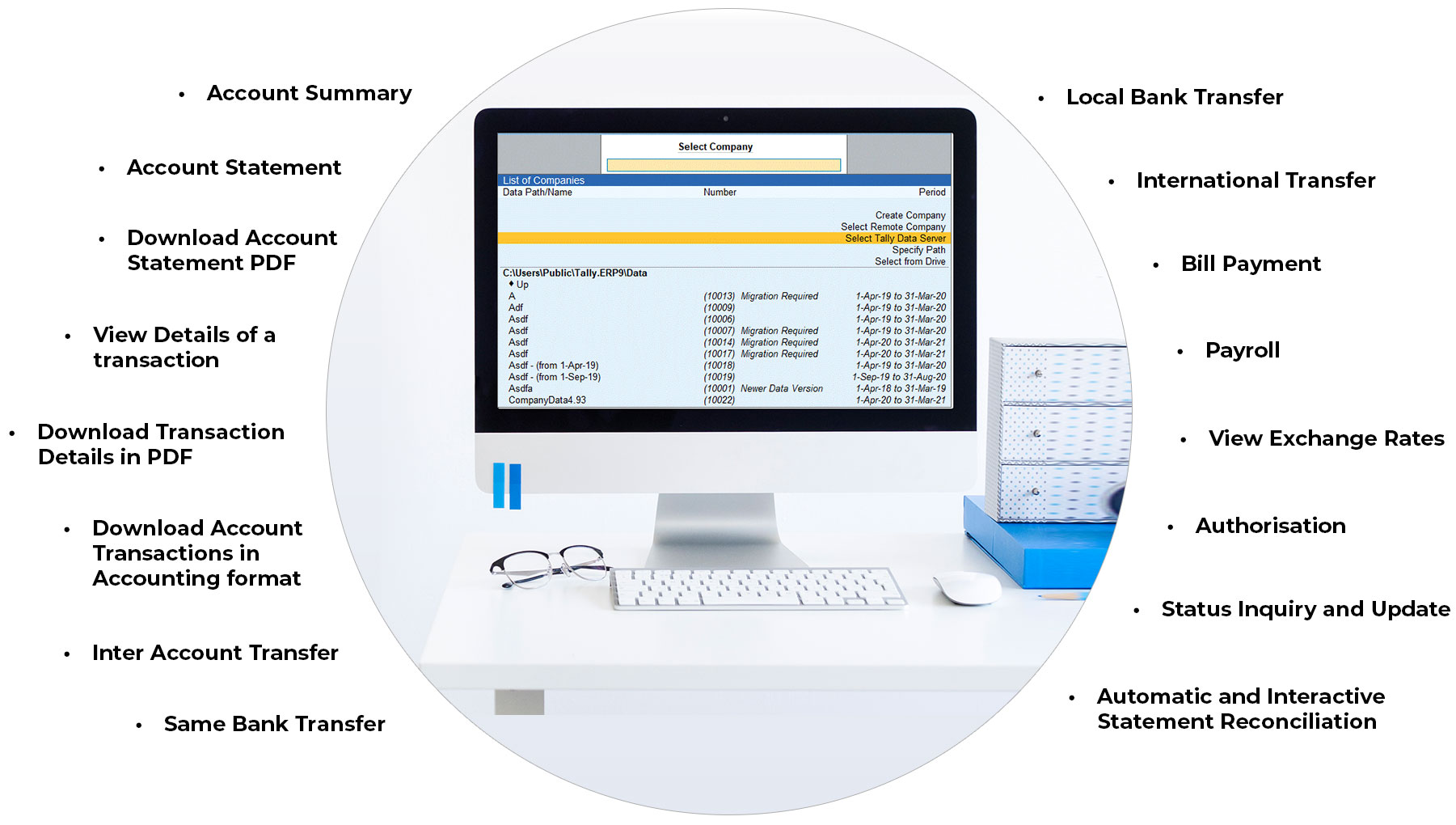

The following banking functions are available to corporate/business customers directly from BankFlex Tally App:

This BankFlex Omni Channel Features as Follows

BankFlex® EASI Banking Transforms the Corporate ERP Landscape:

Highly Secured: All operations are carried out under highly secure infrastructure with Digital Signature.

Fully Audited: : All operations performed are fully audited.

Cross-Channel Experience: The corporate and business customers will be able to experience 100% cross-channel experience in conjunction with other digital channels like Internet banking, Mobile banking, etc.

Automatic Reconciliation: Streamlines financial workflow and statements accurately.

Real Time Monitoring: Tracks the status of payments and transactions in real time, enhancing visibility and control.

Cost Effective: Reduces the dependency on manual interventions, thus cutting operational costs and optimizing manpower.

Efficient: Boosts organizational efficiency by minimizing processing time and simplifying the banking workflow.