Personal Telegram Banking

Overview

Gone are the days when banking meant customers standing in long queues. Consumers are opting for digital banking solutions and methods for convenience and benefits. Conversational Banking speaks to the modern consumer by making banking available at the users’ fingertips.

Social media and messaging apps like Telegram, WhatsApp, SMS and Messenger are hugely popular among all demographics. Telegram, specifically, is preferred by the users due to enhanced privacy and security features. Banks are capitalizing on this digital market to expand their reach and to offer an improved customer experience. On the other side of the spectrum, the customers are also seeking out convenient banking services through messaging platforms they already use. This easy-to-use multi-lingual application is bound to gain in popularity.

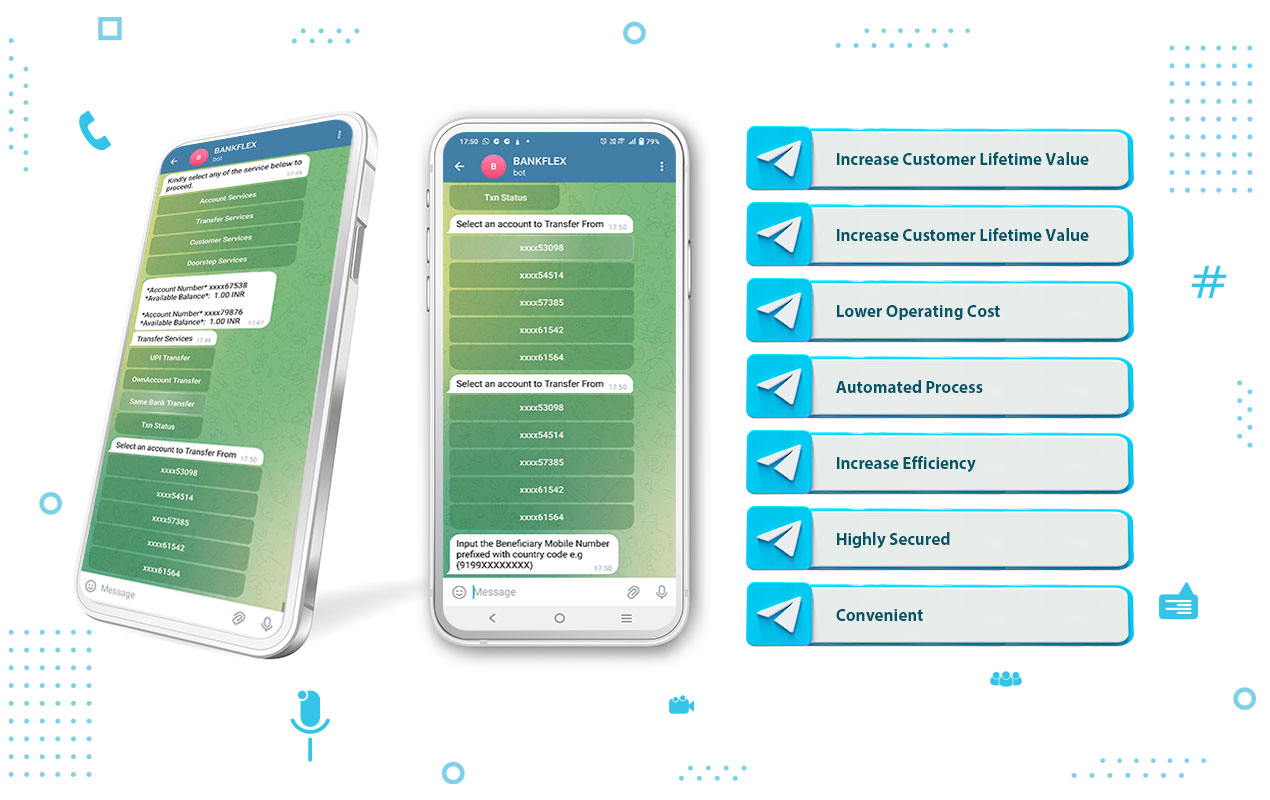

BankFlex® Telegram Banking fulfills these expectations and transforms the way banks interact with customers. The AI-powered, automated banking solution allows users to check balances, pay bills, request statements, transfer funds, and more – all with a simple text message on Telegram. Additionally, BankFlex® Telegram Banking offers premium omni-channel experience with a variety of n-factor authentication processes.

Customers can initiate a series of completely secure banking transactions with a simple “hello”. Because of being easy to configure and maintain, it appeals to demographics like senior citizens and rural residents. With this solution, the banks can connect with customers seamlessly without making any modifications to the core solution.

Customers expect a faster response nowadays and want their queries to be addressed anytime. For better customer experience and response, banks should expand their service 24/7 through the customer’s preferred communication channel. Telegram is preferred by customers for secure communication. BankFlex® ensures complete safety of all transactions of bank customers, through various n-factor authentication processes.

Advantages of Bankflex® Telegram Banking:

Automated Process: BankFlex Telegram Banking offers an automated channel, powered by AI-chatbots.

Convenient: BankFlex Telegram Banking offers a seamless digital experience to both the customers and the banks. While the banks can monitor preferences and offer personalized solutions to the customers using a dashboard, the customers do not need to switch their messaging platform to avail these services.

Improve Customer Experience: BankFlex Telegram Banking offers an improved, easy to use and efficient personalized service to the customers.

Highly Efficient: AI-powered automated responses lead to quick resolution of customer enquiries.

Increase Customer Lifetime Value (CLV): BankFlex Telegram Banking helps the banks build customer loyalty by promoting customer engagement. With 24X7 easy accessibility, end users are more likely to approach bank with their queries. This helps banks collect relevant data and come up with formal channels to engage with their customers.

Lower Operating Cost: By eliminating the need for an additional platform or any changes to the core banking systems, BankFlex Telegram Banking solution helps banks to work efficiently.

Highly Secured: Telegram Banking has end-to-end encryption, making the transactions inherently and transparently secure. To add another layer of security, BankFlex servers ensures that all operations performed are fully audited.

Promotes Personalization: BankFlex Telegram banking helps you tailor your application and personalize responses to your bank customers for an efficient CX (customer experience).

BankFlex® Telegram Banking can make your bank future ready, simply by combining the power of automation, our experience in the field and an established messaging platform.